Selecting the right and best payment gateway for your eCommerce store is a crucial business decision. With an array of choices in the market, it can be quite daunting to discern which option is the optimal fit for your specific needs. It’s about much more than just facilitating transactions; a good payment gateway can enhance customer experience, improve conversion rates, and ultimately drive your business growth.

In this discussion, we will delve into the diverse landscape of payment gateways, examining factors such as ease of integration, fees, security features, customer service, and global acceptance. Our aim is to equip you with the necessary insights to determine the best payment gateway for your eCommerce store. By the end of this exploration, you will be well-positioned to make an informed choice that aligns with your business model, customer expectations, and long-term goals.

What is a Payment Gateway?

A payment gateway is a technology used by businesses to accept and process payments from customers, particularly in online or eCommerce settings. It serves as the digital equivalent of a physical point-of-sale terminal located in most brick-and-mortar retail operations.

When a customer makes a purchase on an eCommerce website, the payment gateway performs several crucial tasks to complete the transaction:

1. Encryption: The web browser encrypts the data to be sent between it and the vendor’s web server. The gateway then sends the transaction data to the payment processor utilized by the vendor’s acquiring bank.

2. Authorization Request: The payment processor sends the transaction data to the customer’s issuing bank asking for the transaction to be authorized.

3. Filling the Order: The issuer responds to the payment processor with a response code (it’s either an approval for an adequate funds situation or a denial if, for instance, the customer’s credit card has insufficient funds). This response code is then sent to the payment gateway which forwards it to the website (or whatever interface was used to process the payment) where it is interpreted and an appropriate response is then relayed back to the cardholder and the merchant. If the transaction fee is approved, the merchant can then fulfill the order.

In essence, a payment gateway serves as a bridge between eCommerce websites and the banking system, ensuring transactions are securely and efficiently processed, thereby contributing to the smooth operation of online businesses.

Best Payment Gateway For eCommerce

Here is a list of the best payment gateways for your eCommerce store:

1. PayPal

When it comes to finding the best payment gateway for your eCommerce store, PayPal stands out for numerous reasons. Imagine PayPal as the trustworthy friend that holds your money while you and a shopkeeper negotiate a deal. Only when both of you are happy, your friend hand over the money to the shopkeeper, ensuring a safe and secure transaction. That’s how PayPal works between you (the online merchant) and your customers.

Trusted Worldwide:

Firstly, PayPal is widely recognized and trusted worldwide. Having PayPal as a payment option can instill confidence in your customers because they know their transactions are secure. Think back to when you were buying your favorite video game online. You saw that little PayPal logo and immediately felt that sigh of relief knowing your payment is safe. That’s the sense of trust and security PayPal brings to your customers.

Seamless Integration:

From a more technical standpoint, PayPal offers a range of USPs or Unique Selling Points. It provides seamless integration with most eCommerce platforms. Think of it like a universal charger that fits almost all your devices. It’s as simple as plugging it in, and you’re ready to go. No matter what eCommerce platform you use – Shopify, Magento, WooCommerce – PayPal is ready to integrate smoothly.

Simple and Competitive Pricing:

One of PayPal’s other strengths is its simple and competitive pricing structure. PayPal doesn’t have any setup or monthly fees. Instead, it charges a fee based on the amount of sales you make. Imagine it like a friend who only asks for a small portion of your ice cream in return for helping you buy it.

Versatile Integration Methods:

Another thing to consider is the variety of integration methods PayPal offers. They have options for all – whether you want your customers to stay on your site during the transaction (via API), want to use iframes, or redirect customers to PayPal’s site. It’s like having different roads to reach your favorite playground. You choose the path that suits you the best!

Robust Customer Support:

When it comes to customer support, PayPal has a robust system in place. They offer support via phone, and email, and also have an extensive self-help section on their website. It’s like having a wise old owl, always ready to help you when you’re stuck.

The Downsides:

On the flip side, PayPal has a few downsides. Sometimes, their fees can seem higher than some other payment gateways when you’re making a lot of sales. And, there have been reports of accounts being frozen due to policy violations. But, as long as you’re following the rules, you should be okay.

PayPal offers a balanced blend of ease, security, and versatility. It’s like the Swiss Army Knife of payment gateways. While there may be a few hitches, its benefits often outweigh the drawbacks, making it an excellent choice for your eCommerce business.

2. Stripe

When deciding on the best payment gateway for your eCommerce store, Stripe comes up as a stellar choice. Imagine Stripe as the superhero of online payments, silently working in the background, making sure all your transactions happen quickly, smoothly, and securely.

User-Friendly Tools:

Stripe holds a strong global reputation and is loved for its clean, developer-friendly tools. It’s like your favorite teacher in school, the one who took that extra step to make learning easy and fun. Stripe, with its user-friendly setup, does just that for your eCommerce site.

Seamless Integration:

Let’s dive into Stripe’s Unique Selling Points (USPs). Firstly, Stripe’s seamless integration across different platforms makes it a go-to for many businesses. Imagine trying to fit a round peg into a square hole – that’s how difficult integration can be with some payment gateways. But with Stripe, it’s as if the peg and hole morph to fit each other perfectly. Whether your platform is Shopify, Magento, or WooCommerce, Stripe fits just right!

Straightforward Pricing:

When it comes to pricing, Stripe maintains a straightforward approach. Much like your favorite pizza place that charges you per slice, Stripe only charges a small percentage per transaction, without any hidden or monthly fees.

Flexible Integration Methods:

For integration methods, Stripe really shines. It provides a variety of options including APIs, allowing payments to be processed right on your site without redirection, like a well-trained guide dog helping you navigate without any unnecessary detours. Stripe can work quietly behind the scenes of your website, ensuring your customers never have to leave your site during the transaction.

Reliable Customer Support:

Just like a friend who always has your back, Stripe has excellent customer support in place. It offers support via email, and chat, and also has an extensive online help center filled with useful resources. So, if you ever run into a hiccup, there’s always a way to get help!

Considerations:

However, every superhero has their kryptonite, and for Stripe, it’s the lack of support for PayPal payments. Additionally, its services might not be available in some countries. It’s like being really good at playing soccer, but not being able to play in some parks.

In a nutshell, Stripe, with its powerful, flexible, and user-friendly features, can be a fantastic choice for your eCommerce store. Despite a few challenges, the advantages it offers are compelling. Just as the right superhero saves the day, the right payment gateway, like Stripe, can make a world of difference to your business success.

3. Amazon Pay

In the vast sea of payment gateway options for your eCommerce store, Amazon Pay emerges as an excellent choice. Think of Amazon Pay like a popular player in your school sports team – everyone knows them, trusts them, and they always play fair. That’s what Amazon Pay brings to your online business: trust, familiarity, and fair play.

The Power of the Amazon Brand:

Now, let’s explore why Amazon Pay is like the golden ticket to the chocolate factory for your eCommerce store. The fact that it’s backed by the world-renowned Amazon brand is its biggest USP or Unique Selling Point. Imagine getting a birthday gift from your favorite aunt – you feel instantly excited because you know it’s going to be good! That’s the kind of instant recognition and trust the Amazon name brings to your online store.

Effortless Integration:

Setting up Amazon Pay on your website is a breeze. It’s like fitting together Lego blocks – designed to fit perfectly without much effort. So, whether your eCommerce platform is Shopify, Magento, WooCommerce, or something else, integrating Amazon Pay won’t be a struggle.

Straightforward Pricing:

When it comes to pricing, Amazon Pay keeps it simple and straightforward. There are no setup or monthly fees, only a small charge per transaction, like buying a ticket for each ride at the amusement park.

Flexible Integration Methods:

In terms of integration methods, Amazon Pay offers a few options. You can process payments directly on your site, use iframes, or redirect customers to Amazon’s site. It’s like choosing between walking, cycling, or skateboarding to school – you pick what’s best for you!

Reliable Customer Support:

And if you ever need help, Amazon Pay’s customer service team is there to assist. They provide support via email, chat, and phone, ensuring you’re never left in the dark. It’s like having a superhero hotline, ready to help when you need it.

Considerations:

However, even superheroes have their challenges. Amazon Pay, while globally recognized, isn’t available in all countries. Also, it’s crucial to remember that some customers may not want to share their Amazon account details with other sites. It’s like that one secret hideout you didn’t want to share with anyone else!

To sum it up, Amazon Pay is a secure and reliable choice for a payment gateway, especially for businesses aiming to tap into Amazon’s massive customer base. Despite a few cons, its trustworthiness, ease of use, and robust customer support make it stand out, just like the star player in your school sports team!

4. Square

Choosing the right payment gateway for your eCommerce store can feel a bit like picking the best pet from a litter of puppies – they all seem good, but Square could just be the perfect fit for you. Square is like that reliable, always-there-for-you pet, making sure your online transactions happen smoothly and securely.

A Suite of Business Management Tools:

Square has a unique appeal, making it a top choice for many online businesses. It’s as if it were that popular kid in school who not only aces classes but also shines in sports and art. Square is not just a payment gateway; it provides a full suite of business management tools, making it a one-stop solution for your eCommerce store – a key Unique Selling Point (USP).

Seamless Integration Across Platforms:

Square’s integration with various platforms is as smooth as making a perfect paper airplane. Whether your eCommerce store runs on Shopify, WooCommerce, or another platform, Square fits in without a hitch.

Transparent and Simple Pricing:

When it comes to pricing, Square is as transparent as a clean glass window. It has a simple fee structure per transaction without any hidden costs or monthly fees. Just imagine going to the candy store and paying just for the candy you buy, without any extra charges!

Multiple Integration Methods:

Square offers multiple integration methods, including APIs for processing payments directly on your site, giving your customers a seamless experience. It’s like having a magic carpet that transports your customers directly to their destination without any detours.

Reliable Customer Support:

And if you ever need help navigating, Square’s customer support is just a call or email away. It’s like having a trusty compass always pointing you in the right direction.

Considerations:

But, just like every puppy has its quirks, Square has a few cons. It isn’t available globally, which could be a limitation if you have an international customer base. It’s like having a fantastic board game but not everyone can play because they live too far away. Also, their fees can add up if you’re dealing with high-ticket transactions. It’s like buying in bulk at the candy store, but the cost per piece remains the same.

Square, with its range of features and simplicity, could be an excellent choice for your eCommerce store. Despite a few challenges, it’s user-friendly nature and comprehensive business tools make it stand out, just like the puppy with the shiniest coat and the most wagging tail!

5. Authorize.net

In the big, exciting world of eCommerce, picking a payment gateway for your store can be as crucial as choosing the best goalie for your school’s football team. In this context, Authorize.Net stands as a strong contender, playing a pivotal role in safeguarding your online transactions just like a goalie protects the net.

Excellent Security Measures:

Now, let’s explore why Authorize.Net could be the star player for your eCommerce team. One of its biggest Unique Selling Points (USPs) is its excellent security measures. It’s as if Authorize.Net is a superhero, whose primary superpower is to shield your transactions from villains like fraud and data breaches.

Seamless Integration Across eCommerce Platforms:

Authorize.Net’s compatibility with various eCommerce platforms is as seamless as finishing a jigsaw puzzle. It doesn’t matter if your store is hosted on Shopify, Magento, or WooCommerce, integrating Authorize.Net is as simple as putting that last puzzle piece into place.

Transparent Pricing:

In terms of pricing, Authorize.Net follows a transparent approach, with a small fee per transaction and a monthly gateway fee. It’s like having a small membership fee for your favorite club and then paying a small amount every time you use the club’s facilities.

Multiple Integration Methods:

Authorize.Net offers a number of integration methods. You can opt to have the payment process happen directly on your site, use iframes, or redirect your customers to Authorize.Net’s site for payment completion. It’s like choosing between different routes to get to school – each one has its advantages, and you can pick the one that suits you best.

Reliable Customer Support:

When it comes to customer support, Authorize.Net is there to help via phone, live chat, or email. It’s like having a knowledgeable guide always ready to help you navigate through your journey.

Considerations:

However, every star player has their weak spots. For Authorize.Net, it’s their limited availability, as they are only accessible in a few countries. Imagine if the best goalie in your district could only play at one local school. Additionally, the cost might be higher compared to other payment gateways, especially for smaller businesses. It’s like ordering a small pizza but being charged for a large one.

Authorize.Net shines as a secure and reliable choice for a payment gateway for your eCommerce store. Despite a few challenges, its commitment to safety and a broad range of features make it a worthy choice, just like a dependable goalie who never lets the team down.

6. WePay

Choosing the best payment gateway for your eCommerce store can feel like selecting the best snack from a vending machine – all options seem appealing, but WePay could be the tastiest treat for your needs. Consider WePay as your favorite snack, providing a satisfying solution for your online transactions.

Social Integration: A Unique Selling Point (USP):

Let’s chew over why WePay could be the perfect choice for your online store. WePay stands out for its social integration, which is a significant Unique Selling Point (USP). Imagine if your favorite snack could talk and play games with you – that’s what WePay brings to your online business with its social media-friendly capabilities.

Seamless Integration Across Platforms:

Integrating WePay with different platforms is as easy as sliding a coin into a vending machine. Whether your eCommerce platform is Shopify, WooCommerce, or BigCommerce, WePay fits right in, making the payment process a breeze.

Clear and Transparent Pricing:

When it comes to pricing, WePay is clear and upfront, with a simple fee structure per transaction. It’s like buying your favorite snack from the vending machine – you know exactly how much you need to pay, with no hidden charges.

Smooth Transaction Process:

WePay provides a smooth transaction process for your customers. Payments can be made directly on your site without any redirection, making it a seamless experience. It’s as if you could get your snack from the vending machine without pushing any buttons!

Reliable Customer Support:

As for customer support, WePay has got you covered. They offer email support and have a comprehensive online help center packed with useful resources. It’s like having a vending machine guidebook to help you understand how to get your snack effortlessly.

Considerations:

But just like every snack has its nutritional pros and cons, WePay too has some drawbacks. While it’s loved for its social integration, WePay isn’t available in all countries. It’s like your favorite snack not being available in all vending machines. Furthermore, some users have reported that their customer service can be a bit slow – it’s like waiting a little longer than you’d like for your snack to drop in the vending machine.

With its strong social integration features and user-friendly setup, WePay could be a fantastic choice for your eCommerce store. Despite a few hiccups, its simplicity and transparency make it a promising pick – just like grabbing your favorite snack from the vending machine at the end of a long day!

7. FirstData

Finding the right payment gateway for your eCommerce store can be as critical as selecting the best ingredients for your favorite sandwich. Among many options, FirstData emerges as a strong choice, acting like that one unique ingredient that brings the whole sandwich together – your transactions, in this case.

Comprehensive Payment Processing Solution:

Let’s discuss why FirstData could be the perfect filling for your eCommerce sandwich. The key feature that sets FirstData apart is its comprehensive solution that covers all aspects of payment processing. It’s like the all-in-one spread for your sandwich that combines all your favorite flavors.

Effortless Integration Across eCommerce Platforms:

In terms of integrating FirstData with various eCommerce platforms, it’s as effortless as spreading butter on a slice of bread. Whether your eCommerce platform is Shopify, BigCommerce, or Magento, FirstData slides in smoothly, making the payment process a cakewalk.

Transparent Pricing Model:

As for pricing, FirstData adopts a transparent model, with costs based on the nature and volume of your transactions. It’s as simple as paying more for a larger sandwich and less for a smaller one, with no hidden extras.

Flexible Payment Processing Options:

When it comes to processing payments, FirstData provides several options. You can choose to handle transactions directly on your site, use iframes, or redirect customers to FirstData’s site for payment completion. It’s like choosing how to layer your sandwich – you pick what works best for you and your customers!

Responsive Customer Support:

And if you ever need assistance, FirstData’s customer support is available to lend a hand via phone and email. It’s like having a sandwich-making expert guiding you at each step.

Considerations:

However, like every sandwich ingredient, FirstData has its pros and cons. While it offers an extensive range of solutions, it could be considered a bit complex for new or small businesses. It’s like having a multi-layered sandwich when all you wanted was a simple peanut butter and jelly one. Also, some users find their fee structure a bit confusing, making it important to read all the details before signing up. It’s like making sure you understand all the ingredients in your sandwich.

FirstData, with its comprehensive suite of payment solutions, can be a robust choice for your eCommerce store. Despite a few challenges, its extensive features make it a strong contender – just like that one ingredient that elevates your sandwich from good to great!

8. 2Checkout

Selecting a payment gateway for your eCommerce store is like picking the best ride at an amusement park. Among the exciting choices, 2Checkout might just be that thrilling roller coaster ride that offers a seamless and enjoyable experience.

Global Transactions:

Let’s dive into why 2Checkout could be the exhilarating ride you need for your eCommerce store. A key Unique Selling Point (USP) of 2Checkout is its ability to handle global transactions. It’s like a roller coaster that can take you on a thrilling ride across different countries in just a few minutes!

Effortless Integration:

Integrating 2Checkout with various eCommerce platforms is as simple as hopping on your favorite amusement park ride. Be it Shopify, WooCommerce, or BigCommerce, 2Checkout fits effortlessly, ensuring a smooth payment journey for your customers.

Clear and Understandable Pricing:

When it comes to pricing, 2Checkout follows a clear and understandable model. They charge a small percentage of each transaction, just like paying a ticket for each ride you take at the amusement park.

Flexible Transaction Handling:

2Checkout offers several ways to handle transactions. Payments can be made directly on your site or by redirecting customers to 2Checkout’s website. It’s as if you could choose between the fast lane or the scenic route to enjoy your roller coaster ride.

Responsive Customer Support:

And if you ever need help, 2Checkout’s customer support is there for you, providing assistance through phone, live chat, and email. It’s like having a friendly amusement park guide always ready to assist you.

Considerations:

However, every ride has its ups and downs, and so does 2Checkout. While it excels in global transactions, some businesses find their additional compliance requirements a bit daunting. It’s like needing to be a certain height to ride the roller coaster. Also, some users have mentioned that their fees can be higher than some other gateways, which is something to consider when deciding on the best ride for your store.

2Checkout, with its global payment capabilities and easy integration, could be a thrilling choice for your eCommerce store. Despite a few bumps along the way, its all-around features make it a roller coaster ride worth experiencing.

9. Adyen

Choosing a payment gateway for your eCommerce store can be like picking out the best pair of shoes for a long hike. Among various choices, Adyen stands out as a sturdy pair of boots that provides solid support and makes the journey comfortable.

Global Payment Methods:

Let’s explore why Adyen could be the perfect fit for your eCommerce store. One of the unique selling points (USPs) of Adyen is its ability to accept a vast range of global payment methods. It’s like a pair of boots that can adapt to any terrain, ensuring you’re ready for any path that lies ahead.

Seamless Integration:

Integrating Adyen with your chosen eCommerce platform is as smooth as lacing up your boots. Whether you’re using Shopify, BigCommerce, or Magento, Adyen fits in seamlessly, making the payment process an effortless walk in the park.

Transparent Pricing:

When it comes to pricing, Adyen adopts a transparent, per-transaction model. It’s like paying for your boots based on the miles you plan to hike, with no unexpected costs or hidden fees.

Flexible Transaction Processing:

In terms of processing transactions, Adyen offers flexibility. Payments can be handled directly on your site, ensuring your customers never have to leave your eCommerce store to complete a purchase. It’s as if the hiking trail looped right back to your starting point, keeping the journey smooth and straightforward.

Responsive Customer Support:

And should you ever need help, Adyen’s customer support is available through phone and email. It’s like having a helpful trail guide ready to assist you at any time.

Considerations:

However, just like every pair of boots, Adyen has its advantages and drawbacks. While it is renowned for its global payment capabilities, smaller businesses might find Adyen’s minimum invoice requirement a bit high. It’s like needing to commit to a long hike when all you wanted was a leisurely stroll. Furthermore, its setup process can be complex for beginners – it’s akin to lacing up a pair of intricate hiking boots for the first time.

In summary, Adyen, with its expansive range of global payment solutions and easy integration, could be a reliable choice for your eCommerce store. Despite a few challenges, its robust capabilities make it a contender worth considering – just like a sturdy pair of hiking boots that might take a little time to break in, but serve you well in the long run.

10. Fondy

Choosing a payment gateway for your eCommerce store can feel like selecting the best toppings for your pizza. Among the many mouth-watering options, Fondy might just be the perfect blend of cheeses that makes your pizza memorable and satisfying.

Simplicity at its Finest:

Let’s delve into why Fondy might be the delectable choice for your eCommerce store. The special topping that Fondy brings to the table is its simplicity. It’s designed for businesses of all sizes and offers an incredibly user-friendly interface. Imagine a pizza place where you can effortlessly choose all your favorite toppings without getting lost in the menu!

Easy Integration:

The integration of Fondy with various eCommerce platforms is as easy as spreading cheese over a pizza base. It’s compatible with several platforms including WooCommerce, PrestaShop, and Magento. So no matter what your eCommerce store is built on, adding Fondy is a breeze.

Clear and Transparent Pricing:

Fondy’s pricing model is as clear and straightforward as a pizza menu. They charge a small fee per transaction, with no hidden costs, allowing businesses to budget effectively. It’s like knowing exactly how much each topping on your pizza will cost, with no surprise charges when you get the bill.

Seamless Checkout Experience:

Fondy offers a seamless checkout experience. Customers stay on your site during the entire payment process, ensuring their journey is as smooth as biting into a well-cooked slice of pizza.

Reliable Customer Support:

In case you need assistance, Fondy’s customer support is readily available. Whether it’s a question about setup or a transaction issue, they are there to help, much like a friendly pizza chef ready to cater to your needs.

Considerations:

However, like every pizza, Fondy has its unique flavor profile. While it’s simplicity and user-friendly design are appealing, it might not offer as many advanced features as some larger payment gateways. It’s like a pizza with classic cheese and tomato – delicious and reliable, but maybe not as exciting as a gourmet special with exotic toppings. Some users have also pointed out that Fondy isn’t as well-known as some other payment gateways, which might be something to consider, just like choosing a popular pizza joint versus a new, lesser-known spot.

Fondy, with its simplicity and easy integration, can be a reliable and tasty addition to your eCommerce store. Despite a few drawbacks, its straightforward and user-friendly approach makes it a tempting choice – much like choosing a classic, satisfying cheese pizza over a fancy one with extravagant toppings.

11. Merchant e-solutions (MeS)

Choosing a payment gateway for your eCommerce store can be compared to finding the perfect instrument for your band. Among the many options available, Merchant e-Solutions (MeS) could be the versatile guitar that adds harmony to your performance.

Comprehensive Payment Solutions:

Let’s explore why MeS might be the musical note that hits the right chord for your eCommerce store. The unique selling point (USP) of MeS is its comprehensive payment solutions. It’s like a guitar that can produce a wide range of sounds, covering everything from soft melodies to intense rock riffs.

Smooth Integration:

In terms of integration, adding MeS to your eCommerce platform is as smooth as tuning a guitar. Whether you’re using Shopify, Magento, or WooCommerce, the setup process with MeS is designed to be hassle-free.

Transparent Pricing:

When we talk about pricing, MeS operates on a per-transaction basis, which means you pay for what you use. This is similar to buying guitar strings – you only need to pay for new ones when the old ones wear out.

Seamless Checkout Experience:

With MeS, transactions can be processed directly on your site. This means your customers won’t be redirected elsewhere to complete their payment, providing a seamless experience. It’s like listening to a song without any interruptions – the music keeps flowing smoothly from beginning to end.

Responsive Customer Support:

In the event you need assistance, MeS offers excellent customer support via phone and email. It’s like having a professional guitar technician always ready to help with your instrument issues.

Considerations:

However, just like every instrument, MeS has its strengths and weaknesses. On the plus side, it offers a wide range of payment solutions and easy integration. But on the downside, smaller businesses might find their fees a little high. It’s like a quality guitar with an excellent range of sounds, but it may not be the best choice for a beginner who is just learning to play.

Merchant e-Solutions, with its broad range of payment solutions and user-friendly integration, could be a strong contender for your eCommerce store. Despite a few drawbacks, it offers robust capabilities that can bring harmony to your business – much like a well-tuned guitar contributing to a successful band performance.

12. SecurePay

Choosing a payment gateway for your eCommerce store is akin to selecting the perfect guard dog for your house. Among the many breeds out there, SecurePay might just be the loyal German Shepherd that effectively safeguards your property.

Security as the Top Priority:

Diving into why SecurePay could be your faithful protector, the primary trait that distinguishes this gateway is, as its name implies, security. It’s like a German Shepherd’s reputation for being a reliable and dedicated guardian. SecurePay puts a priority on protecting your customer’s data, making sure every transaction is as safe as a well-guarded home.

Seamless Integration:

As for integration, introducing SecurePay into your eCommerce platform is as simple as training a pup. Whether you’re using platforms like Shopify, BigCommerce, or WooCommerce, integrating SecurePay is a straightforward process.

Competitive and Transparent Pricing:

When discussing pricing, SecurePay offers competitive rates based on your transaction volume, just like how you might buy dog food in bulk to save money. It’s a fair and transparent system, allowing you to budget effectively without any hidden surprises.

Smooth Checkout Experience:

One of the best features of SecurePay is that customers make their payments directly on your website, providing a smooth checkout experience. It’s like having a guard dog that doesn’t bark at your guests but still keeps a watchful eye on everything.

Responsive Customer Service:

If you ever need help, SecurePay’s customer service is just a phone call or email away. They’re ready to assist you, much like a friendly and knowledgeable dog trainer.

Considerations:

But, like every breed of dog, SecurePay has its strengths and weaknesses. Its security features and easy integration are definitely worth barking about. However, some users have reported that the interface could be a bit more user-friendly. It’s like having a well-trained German Shepherd who’s excellent at guarding the house, but sometimes you wish it was a little more playful.

SecurePay could be a robust and secure choice for your eCommerce store. Despite some minor cons, its emphasis on secure transactions and easy integration makes it an appealing option. It could be the faithful German Shepherd that safeguards your business and gives you peace of mind.

13. Venmo

Imagine your eCommerce store is a popular, happening hangout for your customers, and Venmo is the cool, tech-savvy DJ that gets everyone grooving. Customers, especially the younger crowd, love Venmo because it’s simple, fast, and fun – it’s more than just a payment gateway, it’s an experience!

Social Interaction at its Finest:

Venmo stands out from the crowd by making payments feel like social interaction. It’s like when the DJ shouts out your favorite song on the loudspeaker; you feel included and part of the fun. With Venmo, customers can share their purchases with friends, turning the act of buying into a social activity.

Seamless Integration:

What about setting up the DJ booth? Easy! Integration with Venmo is a breeze, and it syncs up well with major eCommerce platforms. This lets you plug in the DJ console and get the party started in no time.

Affordable and Worthwhile:

Talking about the ticket price to the party, Venmo offers competitive rates, taking only a small percentage per transaction. It’s like paying for an affordable ticket to an awesome concert – you know you’re getting your money’s worth.

App-Based Convenience:

One key feature of Venmo is the app-based interface. Customers complete their payments on the Venmo app, which may feel like leaving the dance floor for a bit. But once they’re there, the process is swift and smooth, and they can jump back into the party in no time.

Reliable Support:

And if anything goes wrong, or if you just need help setting up, Venmo’s support is like the friendly party organizer who’s always ready to lend a hand. They offer email and phone support to ensure you’re never left stranded in the middle of the party.

Considerations:

But just like every DJ, Venmo has its unique style. While the social element of Venmo makes it popular among younger customers, it might not hit the right note with older customers who prefer a more traditional buying experience. It’s like preferring classic hits over electronic dance music; it’s just a matter of personal taste.

Venmo is a cool, trendy choice for your eCommerce store. If your target audience loves to share, engage, and stay connected, this payment gateway will have them dancing to its beat. The minor tune-out might be its social aspect, which could be a turn-off for some, but its USPs make it worth considering.

14. Braintree

Imagine your eCommerce store as an international airport. Now, Braintree is like the multi-lingual, super-efficient air traffic controller that effortlessly guides planes (or payments) from all over the world to land safely and smoothly.

Acceptance of Multiple Payment Types:

Braintree shines in its ability to accept a wide variety of payment types, just like how our air traffic controller handles planes from different countries. With Braintree, your customers can use a multitude of payment methods, including credit and debit cards, PayPal, Apple Pay, Android Pay, and even Bitcoin. This creates a more inclusive experience for customers, regardless of where they’re flying in from or what currency they use.

Seamless Integration:

One of the key selling points of Braintree is its seamless integration method. Integrating Braintree into your eCommerce platform is as easy as clearing the runway for the next landing. Its API works smoothly in the background, making the whole process feel as easy as boarding a plane when everything’s on schedule.

Transparent Pricing:

As for pricing, Braintree offers a pay-as-you-go model where you pay a small fee for each transaction. It’s like buying a ticket for each flight – no yearly contracts or hidden charges.

Reliable Customer Support:

For any turbulence or questions, Braintree provides great customer support with real people ready to assist, like the helpful ground crew at the airport. They’re available through email and over the phone, so you’re never left on your own.

Considerations:

However, just like each airport has its unique layout, Braintree might have a slightly steeper learning curve when it comes to setup. Some users find it a little more complex compared to other payment gateways. It’s like navigating a new airport – it takes a bit of time, but once you get the hang of it, it’s smooth sailing.

Braintree is like a world-class air traffic controller for your eCommerce store. With its ability to handle multiple payment types, seamless integration, clear pricing, and great support, it’s definitely a strong contender in the payment gateway arena. The slight complexity in setup might be a hurdle for some, but the wide range of features it offers makes it a journey worth embarking on.

15. Clover

Let’s picture Clover as a Swiss Army Knife, but for payment processing. It’s multi-functional, compact, and ready for action, perfect for your eCommerce store.

Flexibility in Payment Types:

One thing that makes Clover stand out is its flexibility. Just like how a Swiss Army Knife has tools for different needs, Clover can handle multiple payment types. Whether it’s credit and debit cards, contactless payments like Apple Pay and Google Pay, or digital wallets, Clover has got it covered. This gives your customers the freedom to choose their preferred payment method, making shopping on your website feel as easy and convenient as using a trusty multi-tool.

Seamless Integration:

When it comes to integration, Clover fits seamlessly into your eCommerce store just as a Swiss Army Knife folds neatly into a pocket. It offers different integration methods, allowing you to choose the best fit for your store. You can use iframes or directly connect via API. The best part? It all happens smoothly in the background, so your customers won’t notice a thing. It’s like using the right tool from your Swiss Army Knife without any hassle.

Flexible Pricing and Reliable Support:

For pricing, Clover operates on a tier-based pricing model. This means you only pay for what you use, just like you only use the tools you need from your multi-tool. Their customer support is also up to the mark, ready to help whenever you need them, just as a Swiss Army Knife is always there in times of need.

Considerations:

Of course, even a Swiss Army Knife isn’t without its drawbacks. Clover is best integrated with Clover POS systems, so if you’re using a different POS system, you might encounter some compatibility issues. It’s like trying to use a tool on your Swiss Army Knife for a task it wasn’t designed for – it might work, but it might not be as effective.

Clover, much like a Swiss Army Knife, is a versatile, reliable, and handy tool for your eCommerce store. It provides a variety of payment optionnulls and smooth integration, making it a worthwhile consideration in your eCommerce development plan. With fair pricing and great support, Clover may have its limitations, but it’s definitely worth considering if its features align with your needs in crafting a successful eCommerce platform.

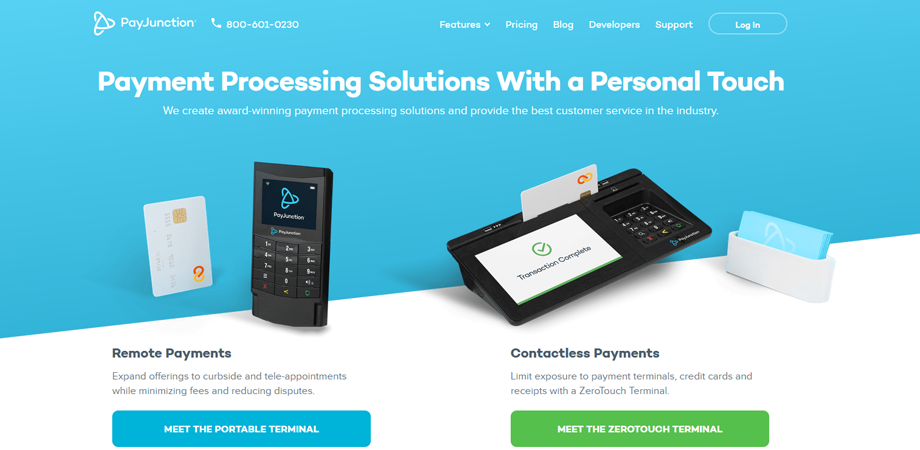

16. PayJunction

Imagine the joy of riding a roller coaster. It’s fast, secure, and offers an unforgettable experience. That’s exactly what it’s like using PayJunction as your payment gateway for your eCommerce store – it’s efficient, safe, and leaves both you and your customers feeling satisfied.

Speed and Security:

Just like how a roller coaster takes you through twists and turns at high speed, PayJunction processes transactions quickly. Its unique selling point (USP) is speed combined with security. It handles various payment options like credit and debit cards, contactless payments, and digital wallets swiftly. Your customers won’t have to worry about long queues, just like when they have a fast pass for a roller coaster.

Seamless Integration:

When it comes to integration, PayJunction is like a roller coaster that fits perfectly into the theme park. It provides easy integration methods through iframes or directly via API. The best part is, the entire integration process occurs in the background, making it a smooth ride for your customers.

Cost-Effective Pricing and Support:

As for pricing, PayJunction offers a cost-effective pricing model, just like a roller coaster that gives you a thrilling ride without burning a hole in your pocket. Its customer support team is always ready to assist you, just like the roller coaster operators ensuring your safety and enjoyable ride.

Considerations:

However, like all roller coasters, PayJunction too has its highs and lows. Its advanced features may feel overwhelming to beginners, just like a high-speed roller coaster might be too much for first-time riders. Another point to note is that while PayJunction offers excellent customer support, their availability isn’t 24/7.

PayJunction is like a high-speed roller coaster ride. It’s fast, and secure, and offers various payment options, easy integration, reasonable pricing, and helpful customer support. Despite some minor limitations, PayJunction could indeed be the exciting ride your eCommerce store needs.

17. Elavon

Picture your favorite superhero. They’re strong, reliable, and always there when you need them. Now, what if your eCommerce store could have a superhero too? Enter Elavon, one of the best payment gateways for your eCommerce store. It’s like a superhero for your online business, making sure all your transactions are safe, quick, and hassle-free.

Wide Range of Payment Options:

Elavon’s superpower is its wide range of payment options, similar to a superhero having different powers for different situations. It accepts all major credit card payments, digital wallets, and even mobile payments. So, no matter what payment method your customer prefers, Elavon is ready to step in, just like a superhero always ready to save the day.

Seamless Integration:

If we talk about integration, think of it as the secret hideout of your superhero. It’s designed in a way that allows it to easily blend into your eCommerce platform using either iframes or API integration. The entire process occurs quietly in the background, like a superhero working undercover.

Flexible Pricing and Supportive Customer Service:

When it comes to pricing, Elavon is like a superhero who believes in fairness. They offer a variety of pricing options to fit different business needs. Their customer support, on the other hand, is like the trusty sidekick who’s always ready to help, ensuring all your queries are answered promptly.

Considerations:

However, every superhero has its weakness, and Elavon is no exception. While their advanced features are commendable, beginners might find it a little difficult to navigate initially. Another area where Elavon could improve is its customer support availability which isn’t around the clock.

Elavon is like a superhero for your eCommerce store. It offers various payment options, easy integration, flexible pricing, and supportive customer service. Although it has a few areas to work on, its advantages make it a solid choice for your eCommerce store.

18. KIS Payments

Let’s take a trip to an amusement park. Imagine a ride that is safe, thrilling, and super fun – that’s exactly what KIS Payments offers for your eCommerce store.

Smooth Transactions for an Enjoyable Ride:

KIS Payments operates much like your favorite roller coaster ride. It takes your customers on a smooth, effortless journey from the start to the finish of their online transactions. Just as roller coasters are designed to be inclusive for all riders, KIS Payments ensures that no customer is left out by accepting all major credit and debit card payments. Whether your customers are thrill-seekers who prefer to use digital wallets or the more traditional ones who like sticking to their trusty credit cards, KIS Payments caters to all.

Effortless Integration for a Seamless Experience:

When it comes to integrating this ride into your eCommerce park, KIS Payments makes it super easy, just like the construction of a flat-packed roller coaster. Whether it’s directly via an API or through iframes, the integration process is smooth and fuss-free.

Competitive Pricing for a Fun-filled Adventure:

Let’s talk about the ticket prices for this ride. KIS Payments is committed to offering a fun experience without breaking the bank. They offer competitive pricing options that are a good fit for different businesses, much like how an amusement park has different ticket packages for different visitors.

Excellent Customer Support for a Guided Experience:

Customer support from KIS Payments is like having a friendly and helpful park employee by your side. They’re always ready to guide you, answering your questions and helping you solve any problems that you might encounter along the way.

Considerations for a Memorable Ride:

But just as every ride might have a height restriction, KIS Payments also has its limitations. While its integration process is seamless, it might require some technical know-how, which could be a hurdle for those less tech-savvy. And while their customer support is commendable, it isn’t available 24/7, which can be inconvenient for some users.

KIS Payments is like your favorite amusement park ride. It offers smooth transactions, easy integration, affordable pricing, and excellent customer support. Despite a few bumps, its overall performance makes it a worthwhile ride for your eCommerce store.

19. Payline

Imagine playing a super engaging video game. You know, the kind that pulls you in with its exciting challenges, rewards you with power-ups, and keeps you playing for hours? That’s the kind of experience Payline brings to your eCommerce store!

Accepting Payments like a Power-Up:

Picture Payline as that irresistible video game that your customers just can’t put down. When it comes to accepting payments, it’s like a power-up for your customers, accepting all major credit cards, e-checks, and even mobile payments. It’s like being equipped with all the right gear to face the game’s challenges.

Integration: Setting up the New Game Console:

The integration of Payline into your online store is as simple as setting up a new game console. You have the choice of embedding it via iframes or linking it directly using an API. So, even if you’re not a programming wizard, you can still get it up and running in no time.

Competitive Pricing: Value for Money:

Now, let’s talk about the price of this video game. Payline offers a competitive pricing structure that fits different business sizes and models. It’s like buying a video game that provides excellent value for money, offering hours of entertainment for a fair price.

Customer Support: Your Game Guide:

On the support side, Payline is like having a game guide that walks you through every step of the way. Their customer service team is always ready to assist, ensuring you and your customers never get stuck on a level without any help.

Drawbacks: Higher Difficulty Levels:

However, just like every video game, Payline isn’t without its drawbacks. While the integration process is fairly simple, if you’re someone who isn’t familiar with APIs or iframes, it could feel like playing a game on a higher difficulty level. Plus, while the customer service is top-notch, the absence of 24/7 support means occasionally, you might have to wait for business hours to resume to get a solution to your problem.

In the world of eCommerce, Payline stands out like a blockbuster video game. With its wide payment options, simple integration, reasonable pricing, and great customer support, it’s a must-have for any online store. It’s like leveling up your eCommerce store to offer your customers a truly immersive and seamless shopping experience!

20. Worldpay from FIS Global

Picture a fantastic amusement park, full of exciting rides, games, and treats. Now imagine that amusement park is your eCommerce store and Worldpay from FIS Global is the ticket that allows your customers to enjoy all the fun.

A Golden Ticket for Payment Variety:

Worldpay is like that golden ticket that allows your customers to enjoy the thrilling ride of online shopping in your store. It’s capable of processing a variety of payments from credit cards, debit cards, e-wallets, and even mobile payments. It’s like giving your customers access to all the exciting rides and games in the park!

Easy Setup, Just Like Walking Through the Entrance:

Setting up Worldpay in your eCommerce store is as easy as walking through the entrance of the amusement park. You have the option to integrate it directly using an API or through redirection to their website. Just like choosing the most thrilling ride, you pick the option that best suits your needs and comfort.

Flexible Pricing, Tailored to Your Business Size:

Now, let’s talk about the ticket price to this amusement park. Worldpay has a flexible pricing model that is tailored to suit businesses of all sizes. So whether your eCommerce store is a gigantic amusement park or a cozy carnival, there’s a price plan that matches your scale.

Robust Customer Support, Your Trusted Park Staff:

What happens when you need help or guidance in the park? Well, Worldpay is there for you just like park staff, ready to assist whenever you need it. They offer robust customer support to ensure that your business runs smoothly.

Imperfections in the Park:

But just like an amusement park, Worldpay isn’t perfect. The integration process might seem a bit complex if you’re new to APIs or iframes, like being on a roller coaster ride for the first time. Also, some users have reported that their customer service, while usually excellent, can sometimes take a little time to respond – a bit like waiting in line for your favorite ride.

In the grand scheme of things, Worldpay stands tall like a roller coaster in an amusement park. With its multiple payment options, straightforward integration, flexible pricing, and robust customer support, it’s a brilliant choice for any eCommerce store. It’s about making your eCommerce store the go-to amusement park where everyone wants to be!

21. Cybersource

Let’s dive into the world of eCommerce and think of your online store as an adventurous treasure island, full of delightful products. In this scenario, CyberSource is like the trusty map that smoothly navigates your customers through their purchasing journey, ensuring a secure and easy transaction at every step of the way.

A Map for All Payment Options:

You see, CyberSource isn’t just any old map. It’s the kind that handles every type of payment your adventurous customers could think of – be it credit cards, debit cards, or even digital wallets. That’s like having a map that shows all the hidden treasures on the island!

Flexible Integration Paths:

When it comes to integrating CyberSource into your eCommerce site, you have different options, much like choosing different paths on a treasure map. You can go with iframes or APIs that run in the background, or you can redirect your customers to their websites. So, whether you want the direct route or the scenic path, CyberSource has you covered.

Tailored Pricing for All:

Pricing for CyberSource is as flexible as the routes on the treasure map. It caters to both small and big businesses, just like a map that works for novice and experienced treasure hunters alike.

Round-the-Clock Customer Support:

And here’s the cherry on top: CyberSource offers round-the-clock customer support. It’s like having a skilled guide ready to help you out, whenever you find yourself stuck in a tricky part of the journey.

Challenges Along the Way:

However, CyberSource is not without its challenges. While most find it to be a helpful guide, some users may find the initial setup to be a bit complicated. It can be like trying to read a map for the first time. And while their customer service is usually top-notch, there may be times when the response is slower than you’d hope, much like a guide who gets momentarily lost.

But in the grand adventure that is eCommerce, CyberSource holds its own as a reliable guide. With its variety of payment options, user-friendly integration methods, tailored pricing, and solid customer support, it can make the journey through your eCommerce store a delightful and secure adventure for every customer. So, let’s set sail and explore the world of eCommerce with CyberSource as our trusted map!

Conclusion:

As we reach the end of our eCommerce journey, we’ve explored a wide range of payment gateways, each with its own unique strengths and considerations. In the end, choosing the best payment gateway for your eCommerce store isn’t about finding the ‘best’ in a general sense. Instead, it’s about finding the best fit for your specific needs, your customers, and your business model.

Consider factors like the ease of integration, the variety of payment methods offered, pricing, customer service, and the overall reliability and security of the platform. It’s also crucial to consider your customers’ needs, preferences, and habits. Remember, a smooth and secure checkout experience can make the difference between a one-time customer and a loyal patron.

Like choosing the best route for a treasure hunt, the ideal payment gateway for your eCommerce store will depend on your specific circumstances, needs, and goals. So, do your research, consider your options, and make a choice that will offer your customers a seamless and secure payment experience. After all, your eCommerce store’s payment gateway is more than just a transaction tool – it’s the final step in your customer’s buying journey and a critical part of their overall experience with your brand.

If you need more assistance in choosing the best payment gateway for your eCommerce store, don’t hesitate to reach out. We’re here to help! Contact us anytime and let’s get your eCommerce journey on the right track.